How to finance your new van - A Vansdirect guide to van finance

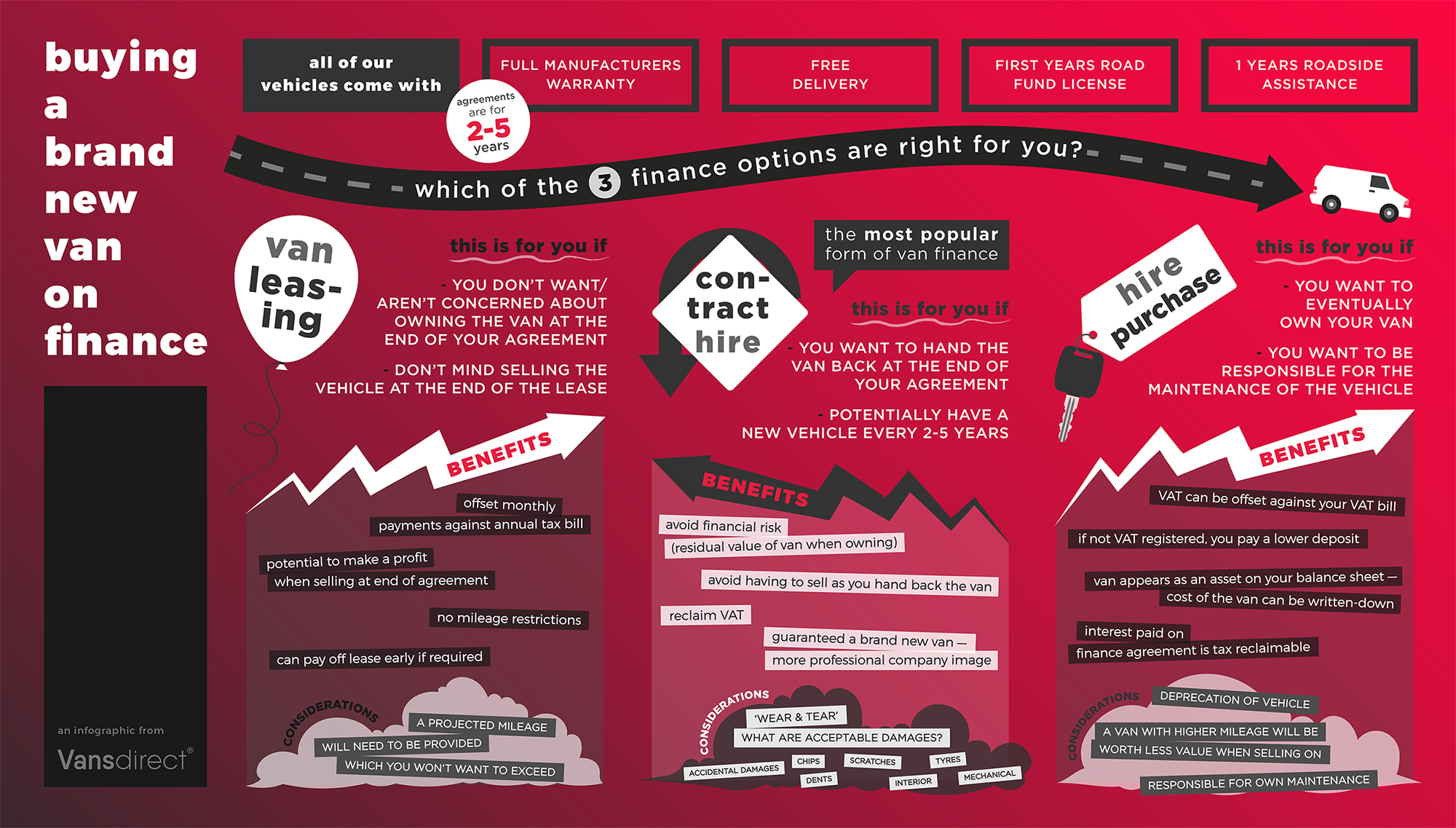

There are a number of different types of van finance and each option will contain certain features to differentiate it from the others, our team of new van experts at Vansdirect take a look at all of the different options available to you!

Van Finance

Introduction to van finance options

Van Finance options are considered to meet specific criteria including convenience and cost. Finance Lease packages for example to offer the cheapest possible option for van drivers, so a van lease agreement is potentially more affordable for SME's and sole traders.

Another popular finance option is Contract Hire, this has been designed with convenience in mind. Contact hire is fundamentally a long-term rental of the van. These packages have similarities with finance lease packages, but also has a significant difference; with contract hire you simply hand the van back at the conclusion of the term, whereas with finance lease you have to sell the van at the end of your van lease to cover a pre-agreed final payment (or balloon payment).

There's also van Hire Purchase, van finance as most people traditionally know it, van hire purchase is the only finance package which allows you to own the van at the end of the contract.

A van finance package consists of a number of different factors, including: deposit, term length, additional features, restrictions, balloon payments. Some of these factors apply to van finance lease, others to contract hire and hire purchase.

Below is a handy table which determines the difference between each of the finance options:

Finance typeDeposit requiredSecurity depositFinance depositTerm lengthBalloon paymentRoad Fund LicenceFree deliveryBreakdown coverOwn the vanMileage restrictionsUsage restrictionsRepair costsServicing & MaintenanceFinance LeaseYES£500minimum 3 rentals down2-5 YearsYES1 YearYES1 YearNOYESYESYESOptionalHire PurchaseYES£500VAT Deposit2-5 YearsOptional1 YearYES1 YearYESNONONONOContract HireYES£500minimum 3 rentals down2-5 YearsNOFull termYES1 YearNOYESYESYESOptional

Van Finance Packages

Whichever package you opt for from the table above, we require a security deposit of £500 to take the van off sale, this is refunded to your account once you have been accepted (or declined) for a van on finance.

The van finance company will also need a minimum initial payment (or rental) of three monthly rentals, this can be higher if you wish and your monthly rental cost will decrease as a result. All of the finance options can be taken out over a period of 24 months to 60 months and all come with free UK wide delivery and a year's breakdown cover. But what are the differences? And which way of getting a van on finance is best for my requirements?

Finance Lease

Van finance lease (or van leasing) involves paying an initial rental (or deposit) to the finance company, the minimum sum that this can be is three monthly payments. Once the term has been completed you are required to sell the van on to cover a final payment (or balloon payment). This payment is calculated using the age of the van at the end of the term as well as the mileage you project at the start of the term.

There are no penalties for exceeding your annual mileage as such, however doing so could affect how much your van is worth when it is time to sell and leave you out of pocket with a van which is worth less than the final payment. You cannot own the van with a finance lease package.

In terms of restrictions with finance lease, the first is mileage which we've just explained, another is to do with signwriting: you can add signwriting to the van, however it must be using removable vinyl (or similar) to avoid damages and there should also be no custom modifications of any kind without approval form the finance company before doing so.

A finance lease package includes 1 year's Road Fund Licence (or road tax), a year's breakdown cover and free delivery to UK mainland. You can opt to include servicing and maintenance with your package at an extra monthly cost, the van lease can also be extended by an additional 12 months should you wish.

Contract Hire

Van Contract hire packages are designed with convenience in mind. Just like a van leasing package, you are required to pay an initial deposit to the finance company, with the minimum deposit being the same, 3 monthly rentals, again you can opt to pay more if you wish.

Throughout your term you are required to stick to your agreed mileage, failing to do this will see you incur additional charges which are calculated by every mile over the agreed mileage that you travel. You can also opt for a maintained package so that all servicing, brakes, tyres and warranty repairs are covered in your contract, helping you budget and keep running costs as low as possible. Contract hire deals also include the Road Fund Licence for the length of your term, as well as a year's breakdown cover and free UK wide delivery. You also cannot own the van with a contact hire finance package.

In terms of usage restrictions, we've already covered those with regards to mileage, there's also restrictions in regards to signwriting: this must be done with removable vinyl (or similar) to avoid damage to the van (if damaged you'll be liable for additional costs) and finally there should not be any custom modifications at all without prior approval from the finance company.

Once the term is completed you hand the van back to the finance company. The van must be in a good state of repair, otherwise you'll be charged for any repair charges at the end of the van lease.

Hire Purchase

Van finance as a lot of people know it, van hire purchase is probably the easiest of the three options to get your head around. This is the only way of getting vans on finance which allows you to own the vans at the end of the term.

As a general rule of thumb although there are exceptions, finance companies will tend to look for a minimum deposit equal to the full VAT of the van for van hire purchase agreements. The benefit of doing this means that your monthly rentals are not subject to VAT (providing you paid a VAT deposit). You are able to pay a lower deposit providing the finance company approves. You can opt to include a final balloon payment if you want to pay a lower monthly rental, however by doing this you will need to pay this at the end of the term.

With van hire purchase the van is essentially yours to keep and do with what you wish, as such there are no restrictions. You can cover whatever mileage you wish, use it however you wish and do whatever you want in terms of signwriting. Maintenance and servicing are up to you, as there are no maintenance options with hire purchase deals.

Included with all van hire purchase packages from Vansdirect is a year's Road Fund Licence, breakdown cover and you guessed it, free UK wide delivery.

For more information on our van finance packages, check out our handy infographic at the top of the article!

Flexible van finance options for everyone's requirements

Looking for a new van on finance? Vansdirect has a team of van experts on hand to help you find the best new van and van finance option for your needs. Simply fill in a contact form or call us on 0800 169 69 95 for a friendly chat regarding all of your new van requirements.